The complete guide to finance and accounting outsourcing services

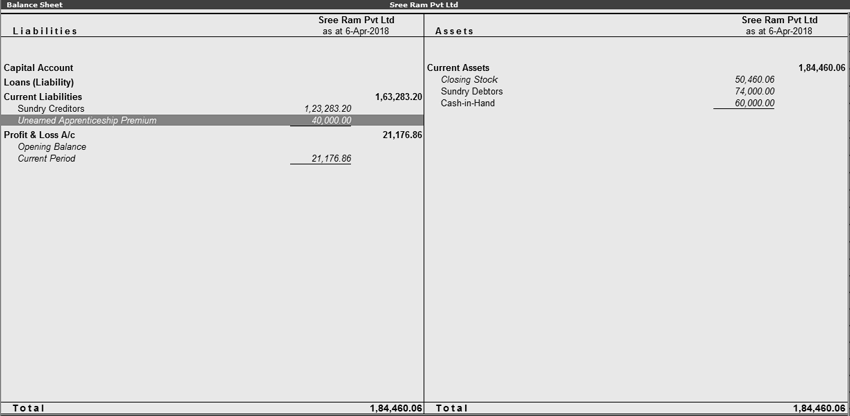

Bill to Cash BPO is a digital platform that helps businesses streamline their sales and billing processes, improving efficiency and customer satisfaction. We use a number of partner apps (Quickbooks, Xero, Smartsheet, etc.) to best meet your business needs. Based on your business needs, we can work with you to determine which apps will best help automate your business processes. We understand that an effective F&A department frees up leadership to focus on horizontal analysis of balance sheets and financial statements other strategic initiatives and priorities. It also provides organizations with scalability and agility to help anticipate and navigate changing business needs. However, if you’re interested in outsourcing, you first need to choose the best outsourcing provider for your needs.

Improving Processes Through Technology

Use a comprehensive communication platform and ensure you communicate your expectations and needs thoroughly to get the most out of your outsourced finance and accounting firm. Thanks to time zone differences, working with a global talent pool allows you to extend your company’s operational hours. Through effective management and communication, you can take advantage of the timezone disparity to massively boost the efficiency of your finance activities. Instead of spending tons of time and money on finding the right employees, hiring an outsourced team allows you to get started immediately. If errors in your books keep appearing, that means the person taking care of your books is not doing the right job. By outsourcing these services, you can take advantage of the multiple layers of review built into your provider’s processes, which allows them to detect most errors on time.

- And since your team may be working from a different time zone, you may be able to extend your company’s operational hours and further boost your financial activities’ efficiency.

- Delivering a client and success-focused service that exceeds expectations requires a clear understanding of our clients strategies, goals, hopes and dreams.

- Access to tax and wealth advisors can assist in building an efficient financial roadmap for your business.

- As all financial services are taken care of by your outsourced team, your in-house employees can spend more time and effort on other roles towards growing your business.

B. Keeping up with the latest technology

Each provider brings a unique set of strengths to the table, and selecting the right one should be a carefully considered decision based on your business’s specific needs and goals. Selecting the ideal finance and accounting outsourcing provider is a critical decision that hinges on aligning their services with your specific business needs. When choosing a provider, consider factors such as the size and nature of your business, industry-specific expertise, and the complexity of your financial requirements. Look for a provider that not only offers a range of services but also demonstrates a deep understanding of your industry’s unique financial challenges and regulatory environment.

We work with leading technology partners such download the avalara ebook “sales and use tax compliance for dummies” as Oracle NetSuite, Sage Intacct, Intuit QuickBooks, Blackline, Tallie and Bill.com. Platforms are regularly upgraded without affecting functionality and as improved technology becomes available, we enhance platform offerings as appropriate, so it’s always up to date. Our HR and Talent BPO services combine deep process and technology expertise to help you create the essential AI-driven HR processes that result in better end-to-end experiences while reducing operational costs. As we explore each provider, it’s important to consider how their unique offerings align with your specific business needs and objectives, ensuring a partnership that fosters growth and financial stability.

We can institute change, or we can lead your F&A department as a long-term, outsourced partner. What sets us apart from internal resources or other providers is the curated talent, managed results and the benefit of the power, perspective and technology of our global network at your disposal. While a project management tool can help you track your progress on tasks, it can’t tell you how productive your outsourced financial team is.

strategies for BPO firms to retain top talent

This approach allows companies to focus on their core business activities while ensuring their financial operations are handled by professionals. In conclusion, the shift towards finance and accounting outsourcing is a strategic decision that can yield significant benefits for businesses of all sizes. By choosing from the top providers, companies can tap into a world of expert financial services, cutting-edge technology, and cost efficiencies.

How do you choose a quality outsourcing provider?

DV Philippines’ commitment to quality and client-centric approach makes them a standout choice for businesses seeking a reliable and globally competent finance and accounting outsourcing provider. Finance and accounting outsourcing is the practice of entrusting a company’s financial services and operations to external experts. This process involves hiring third-party service providers to manage various financial tasks such as bookkeeping, accounting, tax preparation, and financial reporting. The primary goal is to leverage specialized expertise and advanced technologies in the field of finance to enhance efficiency, accuracy, and compliance with financial regulations.

Ultimately, all this may veer you away from your core function and lead to increased operational costs. Machine learning and artificial intelligence are also important trends in finance and accounting. AI, for example, can help companies efficiently compile big data, identify potential market threats, and offer insights to improve their performance. Outsourcing your finance department can help you eliminate traditional accounting methods that rely on manual financial processing and replace them with automated workflows.

This collective expertise enables us to orchestrate value for clients through transformation, insights and technologies like artificial intelligence (AI). In this article, we delve into the world of finance and accounting outsourcing, understanding the landscape, and listing the top outsourcing providers in this domain. Despite its advantages, outsourcing financial services is not without its challenges, including potential loss of control what are examples of cost of goods sold over certain operations, maintaining quality standards, and safeguarding data privacy. Implementing effective governance, establishing clear performance metrics, and maintaining stringent security protocols are essential measures to address these concerns. In such cases, you need to ensure that your financial services provider follows the same regulatory requirements for processing your financial data or personal information as an in-house team would.

For over 20 years, we have been helping our clients navigate the complexities of accounting, tax and business matters. We keep abreast of new trends, policies, and procedures and will always take the time to build strong relationships with our clients. Delivering a client and success-focused service that exceeds expectations requires a clear understanding of our clients strategies, goals, hopes and dreams. Our highly experienced and motivated team are committed to quality in the relationships we form and the work we deliver. BDO manages day-to-day F&A functions and provides your company with creative outsourcing solutions to rethink how specific processes are managed, creating efficiencies and stability to help futureproof your business. Now that you know what your company needs and what you can afford, it’s time to search for service providers.